Mechanical Breakdown Insurance

Next month is the holiday season, xmas and new years break will be here in no time.

How are your cars, servicing up to date? Ready for a road trip?

Peace of mind motoring, is a mechanical breakdown insurance for you?

So, being the guy at the desk organizing the shop, the customers the repairs and quotes, I often find myself asking the question, do you have a warranty or breakdown insurance on your car..? This is often followed by “No, I purchased the car privately”, or ‘Ive had the car for years now”.

Its not common knowledge that you can go out and purchase a policy on your car from the likes of ourselves or various finance companies and car yards around NZ. Providing the car meets the criteria and is checked for any pre-exisiting faults, its just a matter of providing some very basic information and choosing the level of cover you would like.

We can put mechanical breakdown insurance in place for most European cars up to 16 years old and 250,000 kms. All policies come with a 24/7 road side assist if something were to happen while travelling this holiday season and beyond. Seeing some of the failures and the repair bills, we are huge advocates for mechanical breakdown insurance. A good way to future proof yourself against costly repairs with the added bonus of the road side assist. Obviously there are terms and conditions, however in a nut shell we can put in place cover for most European vehicles up to 16 years old and a whopping 250,000kms. Exclusions are the likes of AMG, and RS Audis etc (still an option , but much lower age and km’s restrictions). Any questions, give us a call, happy to assist.

A brief summary of whats covered, in most cases its mechanical and electrical items that are not deemed to be routine maintenance items. We have replaced everything from window regulators to engines. Depending on the level of cover, some policies have a claim limit of up to $10,000 (per claim). This is a significant sum which we have seen spent on a few occasions now on policies. The list of items covered is just too long, however if you had any specific questions feel free to give us a call, I’m sure I will be able to answer most questions on the spot.

FAQ

- Is there a claim excess.,? Yes there is usually $350-$450

- Is there a limit on claims.,? No there is not.

- What do I have to do.,? The car must be serviced every 12 months, and in most cases, Diesels are 10,000km and Petrol’s are 15,000. So annually or by km’s, whichever comes first.

- Are oils and fluids covered on claims.,? On the top tier policies, yes they are, IE A water-pump

- job may need fresh coolant. Also often covered are wheel alignments, freight, diagnostic scan tools if they are required to complete the job. Lower tier cover these would be additional.

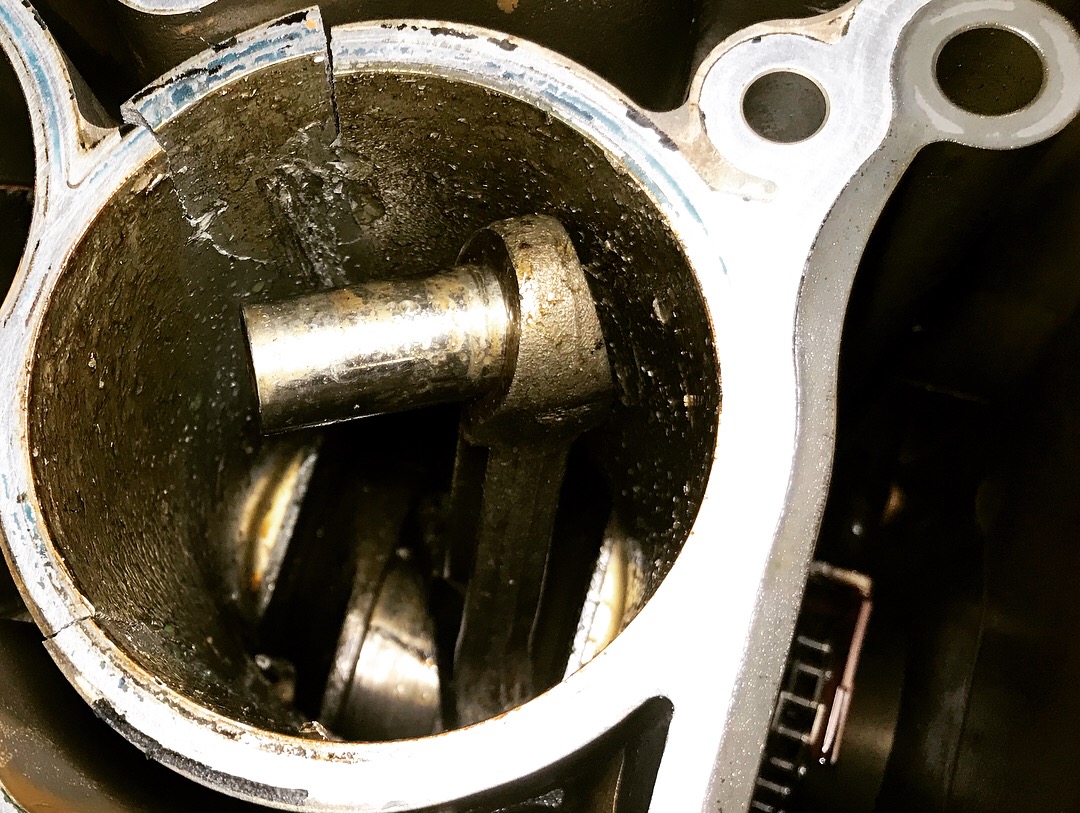

Below is an engine failure, had the policy been in place in time I’m sure the repairs would have been covered, as it is this cost many thousands to replace the engine and all the additional items required to be able to guarantee the job..